We are the Burstone Group

R42.4bn

GAV

R23.8bn

Third-party equity under management

50+

Real estate professionals

We are a fully integrated international real estate business. We invest in best-in-class assets in select markets across the world.

Our people and our culture are at the heart of our business.

Best-in-class assets across select markets

Our board

Our board provides ethical leadership and guidance to deliver long-term value to all stakeholders and is committed to ensuring that good governance practices are applied throughout our business.

Leadership team

Our senior leadership team have extensive experience in operating in property markets across the world, with a deep-rooted understanding of how to deliver excellence in client service and maximise total return. Meet the team.

Building on strong foundations

Listed on the Johannesburg Stock Exchange (South Africa) since 2011, the Fund has a strong management track record of more than 30 years operating in both local and international markets.

Internationally, the Fund has invested in, and built platforms in markets where its operating teams have extensive on-the-ground experience and proven track records.

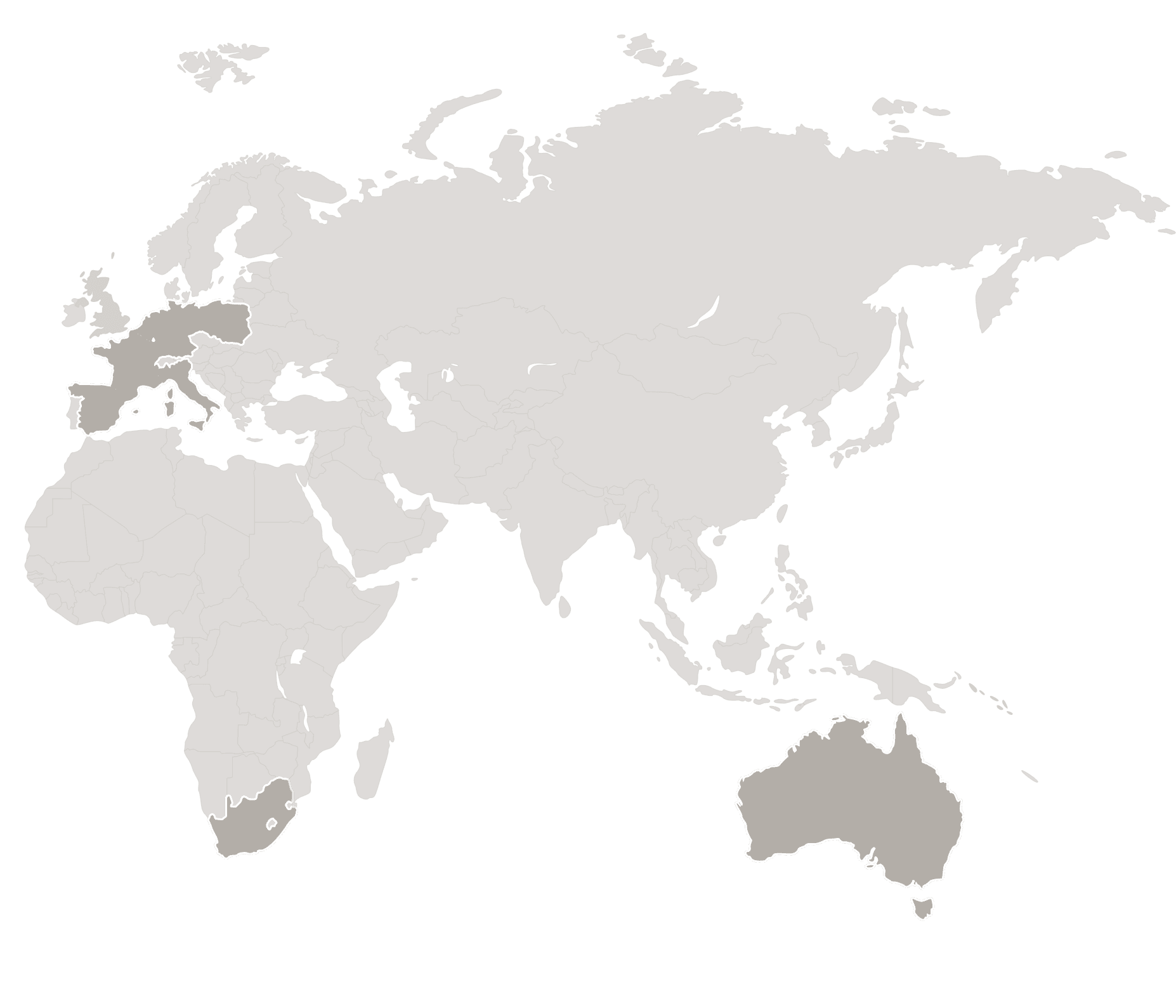

We operate across 9 countries

South Africa

In South Africa, the Fund pursues a predominantly core investment strategy with a focus on quality income-producing assets in traditional asset classes

The South African portfolio comprises 58 properties valued at c. R13.2 billion diversified across the retail, industrial and office sectors:

Retail – niche assets or those that are the dominant offering within their respective locations.

Office – multi-tenanted low-rise buildings, with ability to be well amenitised.

Industrial – good-quality functional space in established nodes with consistent / stable demand.

Europe

In Europe, the Group has entered into a strategic partnership with Blackstone to grow the Group’s c.€1.0 billion Pan-European (PEL) portfolio. Burstone retains a 20% co-investment in the PEL platform while continuing to manage the portfolio’s assets.

The underlying portfolio comprises 32 logistics properties located in seven jurisdictions across Europe, including the core countries of Germany, France and the Netherlands where the majority of the portfolio is situated.

In Europe, the Group currently targets midsize and big-box logistics facilities in core Western European markets where it adopts a core-plus or value-add investment strategy to unlock value from both income-producing assets and development opportunities.

Australia

In Australia, the Fund has established a 50 / 50 joint venture with the management team of the Irongate Group fund management platform.

The Irongate JV has an LP investment in the Irongate Templewater Australia Property (ITAP) Fund and a c.20% co-investment in an industrial platform alongside Phoenix Property Investors.

The Irongate JV has announced a new industrial joint venture with TPG Angelo Gordon, a leading global alternative asset management firm.

Post the current identified pipeline total equity under management is expected to increase c.40% since acquisition, from A$450 million to A$624 million